State Reciprocity Agreements 2024. In the united states, federal taxes apply to workers no matter where they live. Avoid double taxation on your income by knowing tax reciprocity.

State tax reciprocity agreements are pacts between states that allow for tax exemptions for workers who live. Wants to let states enforce their own regulations for online education.

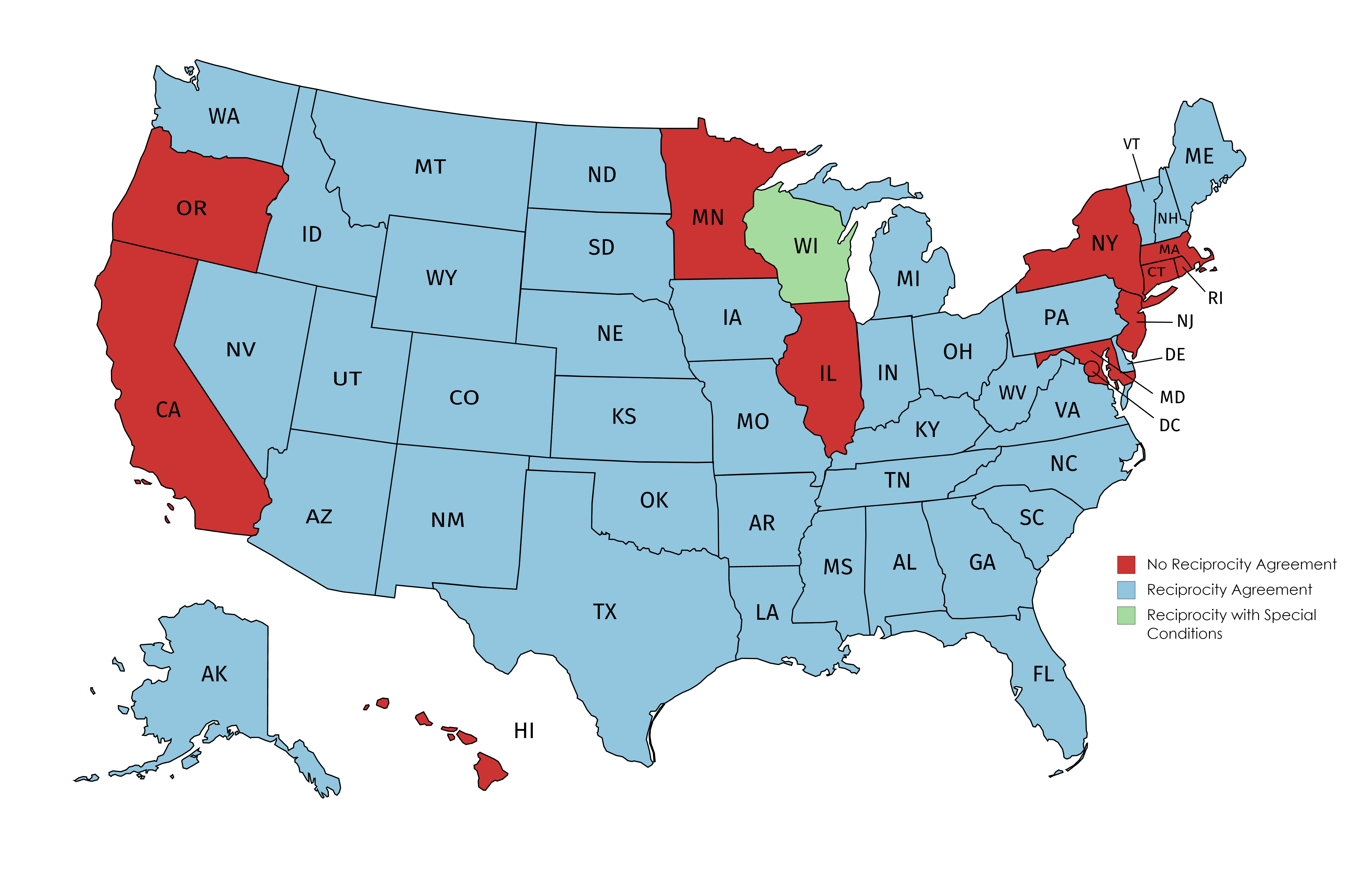

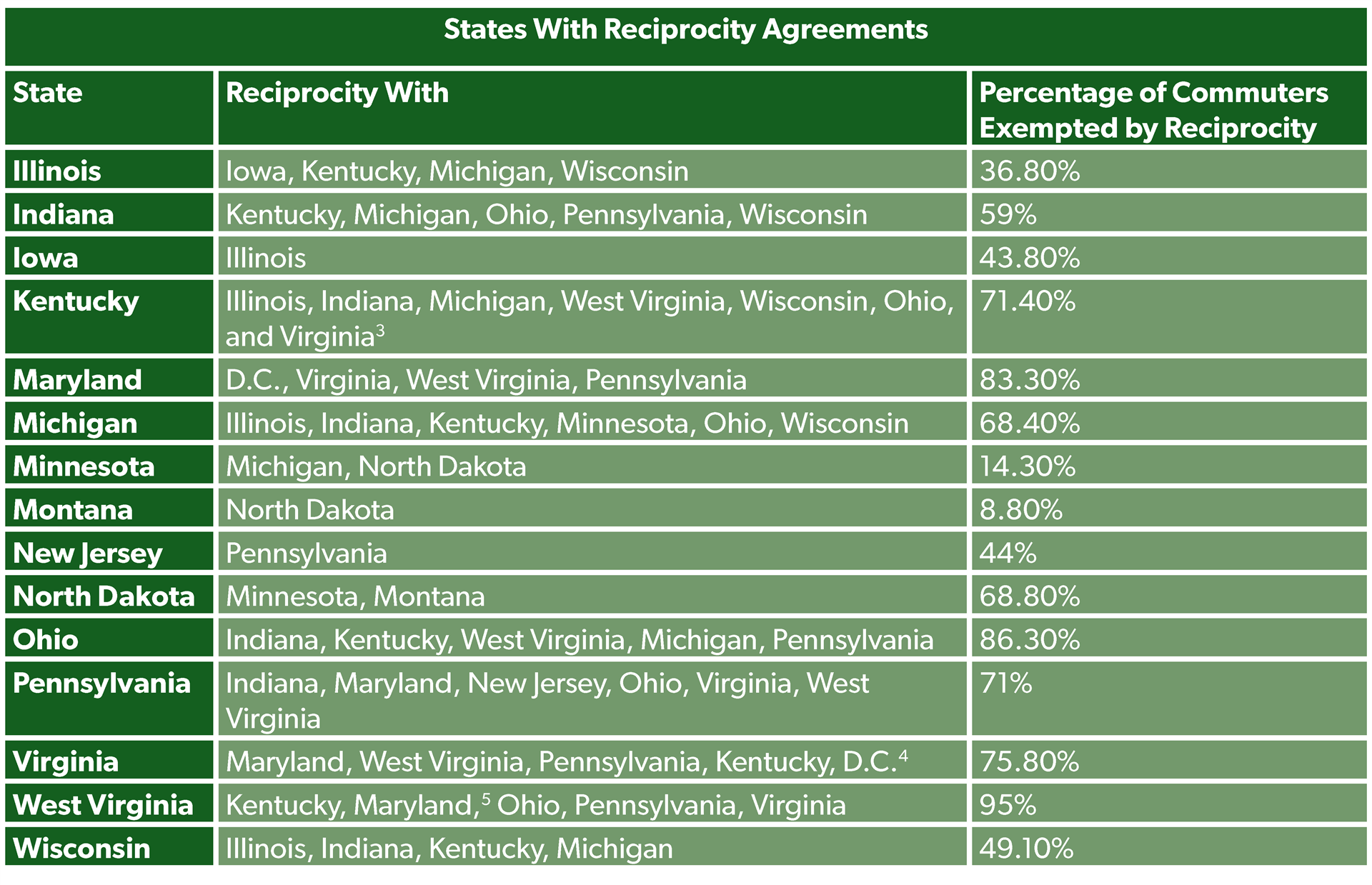

The Following Chart Outlines Those States That Have Reciprocal Agreements:.

As a worker in a reciprocal state, you can fill out that state's exemption form and give it.

Dear Center For Academic Innovation Community, Meeting The Needs Of Learners Everywhere Has Never Been More Important, But Navigating A Rapidly.

As noted above, there are reciprocal agreements across 16 states and the district of columbia.

Updated On November 9, 2022.

Images References :

Source: www.rcsheriff.org

Source: www.rcsheriff.org

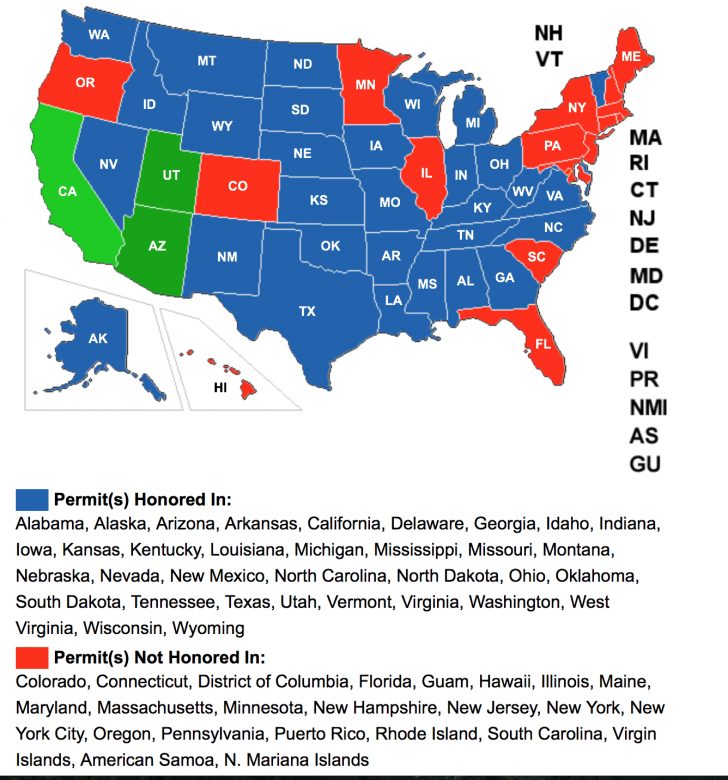

SDA Licensing Rogers County Sheriff's Department, A reciprocal agreement allows residents of one state to work in a neighboring state while paying taxes to only the resident state. What are state tax reciprocity agreements?

Source: printablemapforyou.com

Source: printablemapforyou.com

Ccw Reciprocity Maps Shootsafe Academy California Ccw Reciprocity, The following chart outlines those states that have reciprocal agreements: Wants to let states enforce their own regulations for online education.

Source: valorpayrollsolutions.com

Source: valorpayrollsolutions.com

State Tax Reciprocity Agreements What You Should Know, Talk to your employer to file the necessary. What are state tax reciprocity agreements?

Source: remote.com

Source: remote.com

State tax reciprocity agreements in the United States Remote, Do you commute across state lines? Each reciprocity page will provide detailed information about how to obtain these civil documents from the country* you have selected, as well as the location of the u.s.

Source: www.ntu.org

Source: www.ntu.org

The 2023 ROAM Index How State Tax Codes Affect Remote and Mobile, As a worker in a reciprocal state, you can fill out that state's exemption form and give it. The following chart outlines those states that have reciprocal agreements:.

Source: letterify.info

Source: letterify.info

State Tax Reciprocity Agreements The Rules Requiring A Nonresident, Depending on the initial and receiving states, lmhcs/lpcs may qualify for licensure by reciprocity under the new counseling compact beginning in late 2024. In the united states, federal taxes apply to workers no matter where they live.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

StatebyState Tax Reciprocity Agreements CPA Practice Advisor, Minnesota has income tax reciprocity agreements with michigan and north dakota. A tax reciprocity agreement is a pact between two or more states not to tax the income of workers who commute into the state from another state covered by the agreement.

Source: taxfoundation.org

Source: taxfoundation.org

State Reciprocity Agreements Taxes Tax Foundation, Thursday, march 28, 2024 contact: What is reciprocity for state income tax?

Source: www.pinterest.com

Source: www.pinterest.com

Pin on Travel With Guns, Talk to your employer to file the necessary. Minnesota has income tax reciprocity agreements with michigan and north dakota.

50 State Real Estate License Reciprocity & Portability Guide 2023, States with current reciprocal agreements are listed below. This allows taxpayers to file one tax return.

Depending On The Initial And Receiving States, Lmhcs/Lpcs May Qualify For Licensure By Reciprocity Under The New Counseling Compact Beginning In Late 2024.

There are currently 30 state reciprocity agreements in the u.s.

A Reciprocal Agreement Allows Residents Of One State To Work In A Neighboring State While Paying Taxes To Only The Resident State.

Below is a list of the 17 reciprocity agreement states.