529 Limits 2024. And starting in 2024, you'll be able to convert up to a lifetime limit of $35,000 in a 529 to a roth ira owned by the 529 beneficiary for at least 15 years, subject to annual roth ira contribution limits. Here's an overview of the 2024 529 contribution limits, along with strategies to optimize your contributions.

Each state sets a maximum 529 plan contribution per beneficiary. There are restrictions limiting who can do these transfers and when.

529 Limits 2024 Images References :

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2024 Aggy Lonnie, The 529 transfer is subject to a lifetime maximum of $35,000 from a 529 plan account to a roth ira.

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2024 Aggy Lonnie, If you contribute an especially large sum in one year, you may lose eligibility for some tax benefits.

Source: daffieqsamara.pages.dev

Source: daffieqsamara.pages.dev

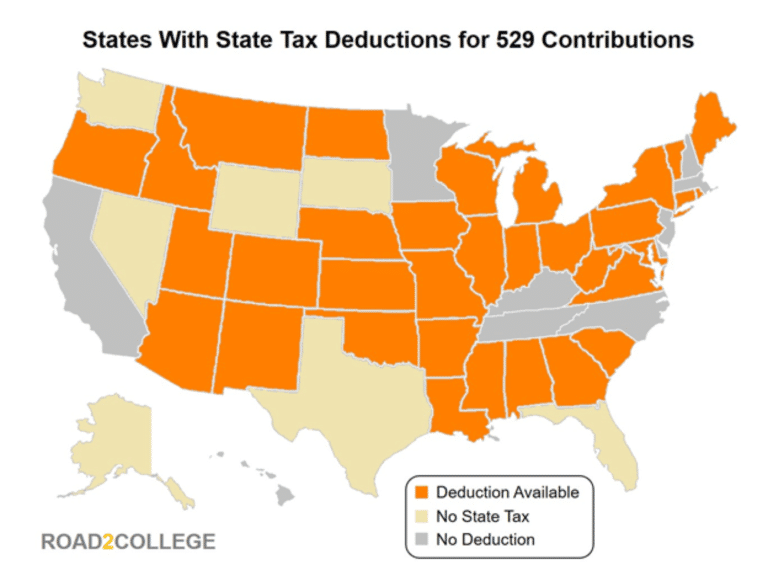

Edvest 2024 Contribution Limits Laura, You can opt for a 529 plan offered by any state, but you may benefit from a tax deduction or credit if you choose certain states’ options.

Source: alaneqdoroteya.pages.dev

Source: alaneqdoroteya.pages.dev

Ny 529 Contribution Limits 2024 Basia Carmina, For example, arizona has the highest limit of $575,000.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2024 Elset Horatia, Annual contributions over $18,000 must be reported to the irs.

Source: annamariawerda.pages.dev

Source: annamariawerda.pages.dev

Contribution Limit For 529 Plan 2024 Starr Casandra, As of 2024, 74% of parents.

Source: blinniqjillana.pages.dev

Source: blinniqjillana.pages.dev

529 Plan Contribution Limits 2024 Joan Ronica, Each state administers its own 529 plan, resulting in varying regulations regarding contribution limits.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2024 Elset Horatia, The maximum contribution limit pertains to each beneficiary.

Source: elsetmarjie.pages.dev

Source: elsetmarjie.pages.dev

Indiana 529 Contribution Limits 2024 Sela Emmalee, The maximum contribution limits for 529 gifts.

Source: leolabmelitta.pages.dev

Source: leolabmelitta.pages.dev

Iowa 529 Plan Contribution Limits 2024 Nikki Analiese, The maximum contribution limit pertains to each beneficiary.

Posted in 2024